Market Outlook

August 16, 2019

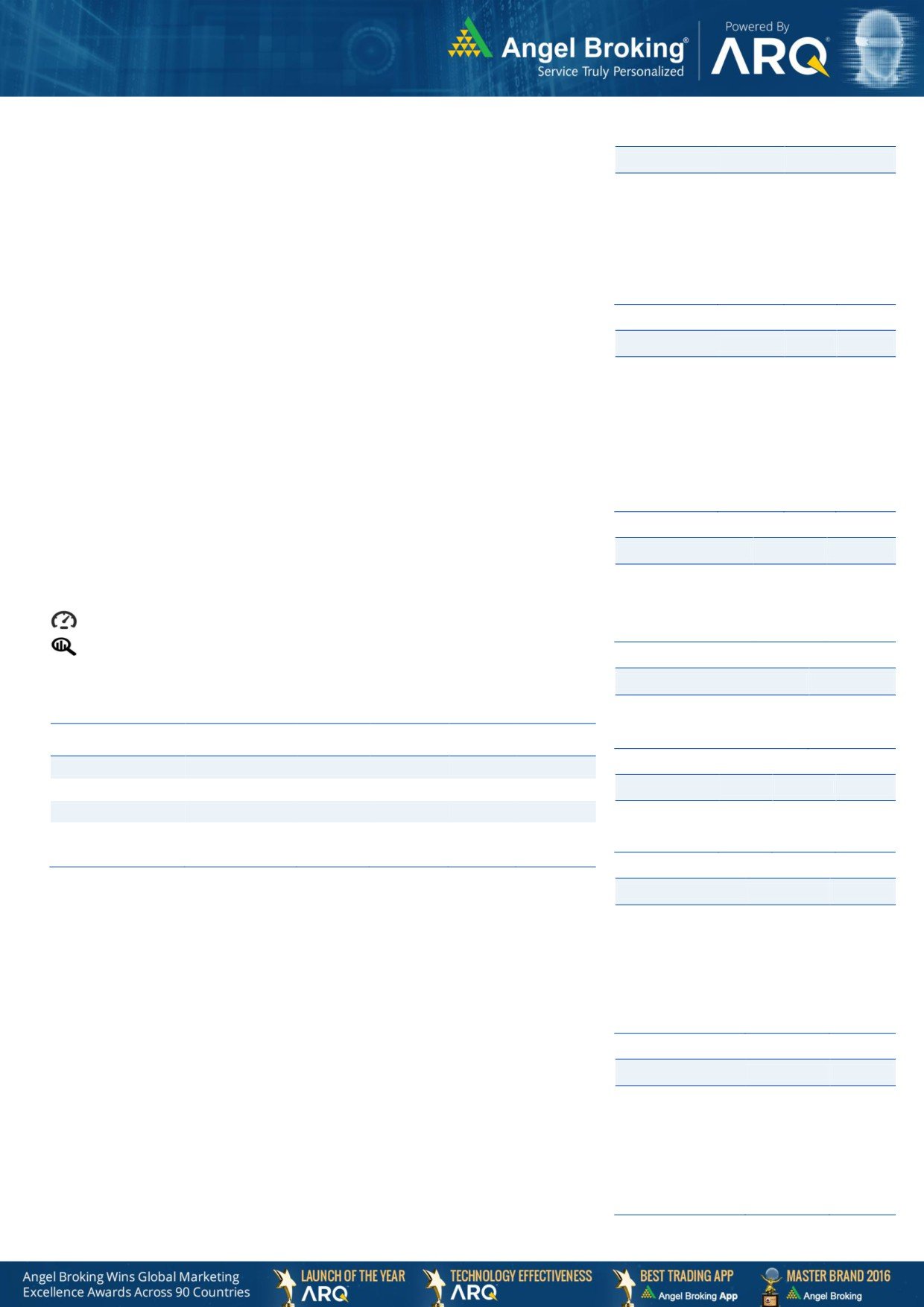

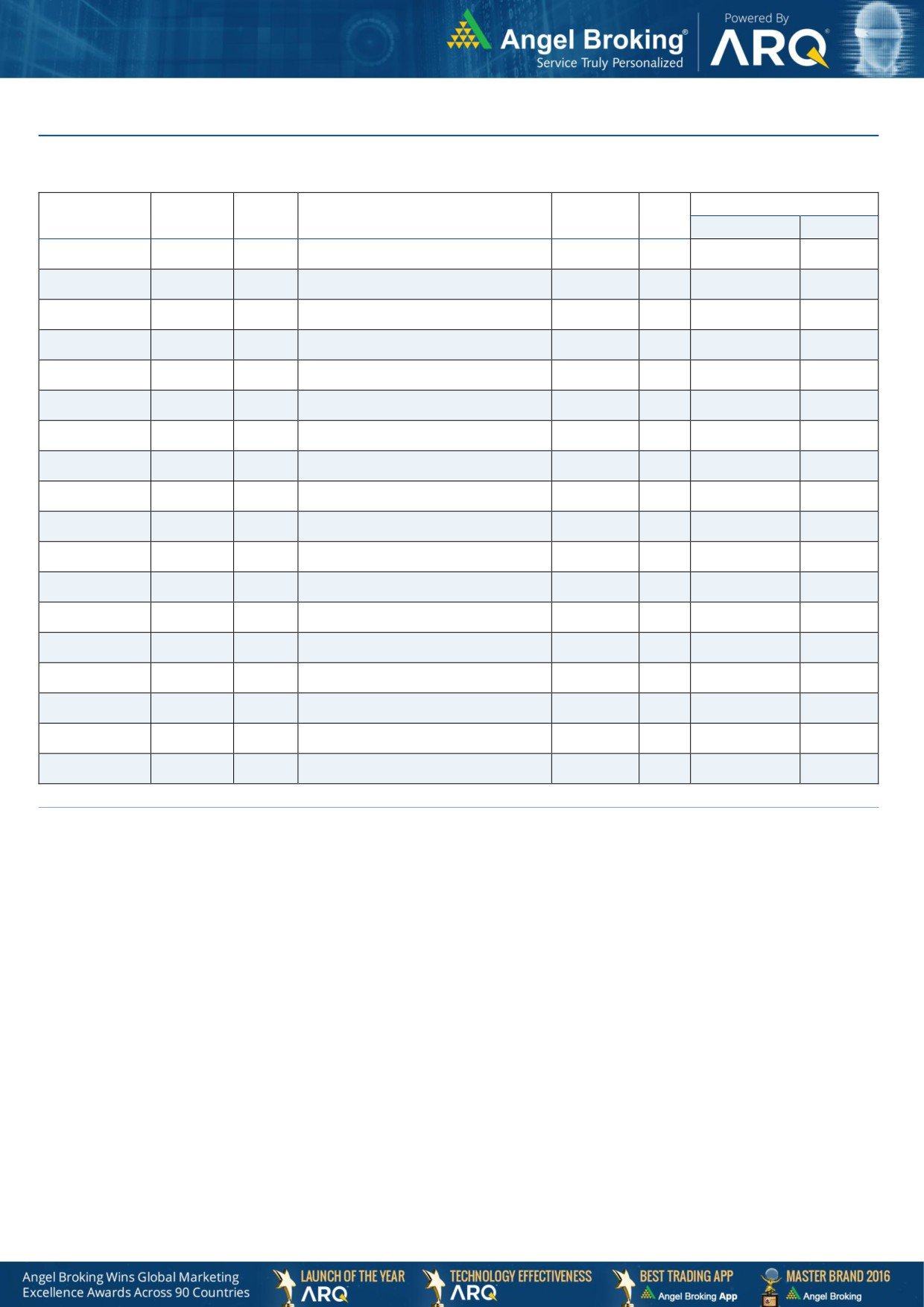

Market Cues

Indian markets are likely to open positive tracking global indices and SGX Nifty.

Domestic Indices

Chg (%)

(Pts)

(Close)

The US stocks stocks have shown a lack of direction over the course of the trading

BSE Sensex

1

353

37,311

day on Thursday. The major averages have spent the day bouncing back and forth

Nifty

1

104

11,029

across the unchanged line. The Dow was up modestly by 0.4 percent to 25,579 and

Mid Cap

0.9

114

13,477

the Nasdaq was flat at 7,767.

Small Cap

0.4

51

12,570

U.K. markets opened lower on Thursday and stayed that way throughout the session

Bankex

1

313

31,652

on continued concerns about the health of the global economy. The FTSE 100 fell by

1.1 percent to 7,067.

Global Indices

Chg (%)

(Pts)

(Close)

On domestic front, Indian shares rebounded from their worst fall in over a month on

Dow Jones

0.4

100

25,579

Wednesday as the U.S. announced a delay in the implementation of tariffs on some

Nasdaq

(0.1)

-7

7,767

Chinese products and a lower than expected wholesale price index reading for July

FTSE

(1.1)

-81

7,067

raised hopes of further cuts in interest rates going forward. The benchmark BSE

Nikkei

1

200

20,655

Sensex jumped by 1.0 percent to 37,311.

Hang Seng

0.1

21

25,302

News Analysis

Shanghai Com

0.4

12

2,809

June quarter earnings show no signs of a revival for Indian companies

Advances / Declines

BSE

NSE

Detailed analysis on Pg2

Advances

1,320

949

Investor’s Ready Reckoner

Declines

1,150

808

Key Domestic & Global Indicators

Unchanged

145

339

Stock Watch: Latest investment recommendations on 150+ stocks

Refer Pg5 onwards

Volumes (` Cr)

BSE

5,787

Top Picks

CMP

Target

Upside

NSE

33,437

Company

Sector

Rating

(`)

(`)

(%)

Blue Star

Capital Goods

Buy

713

867

21.5

ICICI Bank

Financials

Buy

411

490

19.4

Net Inflows (` Cr)

Net

Mtd

Ytd

Parag Milk Foods

Others

Buy

174

330

89.9

FII

(437)

(9,156)

59,090

Bata India

Others

Accumulate

1,433

1,643

14.7

*MFs

2,898

11,665

19,760

KEI Industries

Capital Goods

Buy

481

612

27.4

More Top Picks on Pg4

Top Gainers

Price (`)

Chg (%)

IDEA

6

12.2

RELINFRA

49

9.7

JINDALSTEL

104

9.6

KSCL

479

9.0

SPICEJET

139

8.9

Top Losers

Price (`)

Chg (%)

GICHSGFIN

214

-10.7

JAMNAAUTO

33

-4.9

SUNPHARMA

417

-4.7

GLENMARK

384

-7.9

KNRCON

238

-4.9

As on Aug 14, 2019

Market Outlook

August 16, 2019

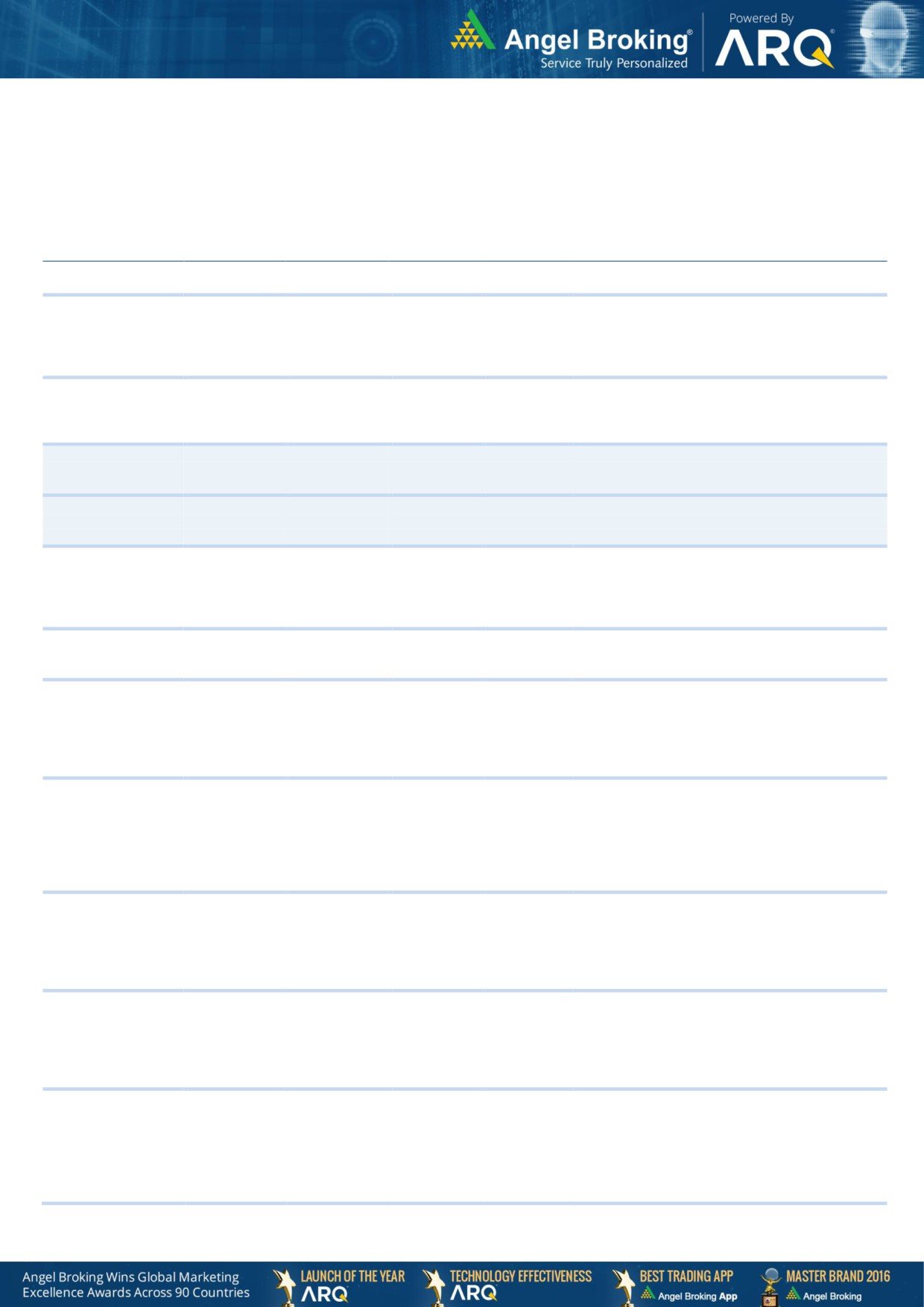

News Analysis

June quarter earnings show no signs of a revival for Indian

companies

Weak demand, slow private sector capital expenditure, liquidity tightness and

sluggish government spending in the poll season continued to take its toll on

corporate India’s earnings in the June quarter. Net profit fell by 5.23% for the

three months ended 30 June from a year earlier, showed an analysis of 1,284

listed companies.

While the June quarter earnings were incrementally better than those of the

preceding three months, in which they fell by 8.46%, a full recovery may still be far

away. In the same quarter last fiscal, the same set of companies had registered a

yearly earnings growth of 21.1%. Analysts said revenues of some companies were

hit by muted volumes owing to low discretionary spends, rupee fluctuations, slow

progress of the monsoon and delayed private sector spending, while lower prices

of commodities such as crude oil offered some respite. In the June quarter, net

sales grew 4.6%, an eight-quarter low, slower than the 14.2% growth in the

preceding three months, according to data provider Capitaline. This compares to

net sales growth of 19% in first quarter of FY19.

During the quarter, operating profit margin narrowed to 19.42% from 19.56% a

year earlier. The review excludes banks, financial services and oil and gas firms,

as they follow a different revenue model.

Economic and Political News

PM holds meet with Sitharaman and officials to weigh booster dose options

Reduction in use of chemical fertiliser needs a roadmap, say experts

EPFO may appoint HSBC AMC, UTI AMC, SBI MF as fund managers for 3-yr

term

At 1.08%, WPI inflation rate slips to over two-year low in July

Corporate News

Reliance Industries may buy more cable companies to aid JioFiber plans

Market share loss dents Shree Cement's June quarter performance

Arvind SmartSpaces plans expansion, eyes Mumbai and Hyderabad markets

ONGC lines up Rs 83,000 crore investment for 25 new oil, gas projects

Standard Life sells 3.3% stake in HDFC Life Insurance for Rs 3,220 crore

Market Outlook

August 16, 2019

Top Picks

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Favorable outlook for the AC industry to augur well

for Cooling products business which is out pacing

Blue Star

6,830

709

867

22.3

the market growth. EMPPAC division's profitability

to improve once operating environment turns

around.

Well capitalized with CAR of 18.1% which gives

sufficient room to grow asset base. Faster

ICICI Bank

2,69,401

417

490

17.4

resolution of NPA would reduce provision cost,

which would help to report better ROE.

High order book execution in EPC segment, rising

KEI Industries

3,696

468

612

30.7

B2C sales and higher exports to boost the revenues

and profitability

GST regime and the Gujarat plant are expected to

Maruti Suzuki

1,75,676

5,816

8,552

47.1

improve the company’s sales volume and margins,

respectively.

Third largest brand play in luggage segment

Increased product offerings and improving

Safari Industries

1,241

556

1,000

80.0

distribution network is leading to strong growth in

business. Likely to post robust growth for next 3-4

years

We expect financialisation of savings and

Aditya Birla Capital

19,405

88

130

47.5

increasing penetration in Insurance & Mutual fund

would ensure steady growth.

One of the leading Indian dairy products

companies in India created strong brands in dairy

products. Rising revenue share of high-margin

Parag Milk Foods

1,419

169

330

95.7

Value Added Products and reduction in interest cost

is likely to boost margins and earnings in next few

years.

HDFC Bank maintained its steady growth in the

4QFY18. The bank’s net profit grew by 20.3%.

Steady growth in interest income and other income

HDFC Bank

6,09,715

2,230

2,660

19.3

aided PAT growth. The Strong liability franchise

and healthy capitalisation provides strong earning

visibility. At the current market price, the bank is

trading at 3.2x FY20E ABV.

We expect strong PAT growth on back of healthy

growth in automobile segment (on back of new

launches and facelifts in some of the model ) and

M&M

65,069

523

1,050

100.6

strong growth in Tractors segment coupled by its

strong brand recall and improvement in rural

sentiment

Market leader in the room air conditioner (RAC)

outsourced manufacturing space in India with a

market share of 55.4%. It is a one-stop solutions

Amber Enterprises

2,557

813

910

11.9

provider for the major brands in the RAC industry

and currently serves eight out of the 10 top RAC

brands in India

BIL is the largest footwear retailer in India, offering

footwear, accessories and bags across brands. We

expect BIL to report net PAT CAGR of ~16% to

Bata India

18,644

1,451

1,643

13.3

~`3115cr over FY2018-20E mainly due to new

product launches, higher number of stores addition

and focus on women’s high growth segment and

margin improvement

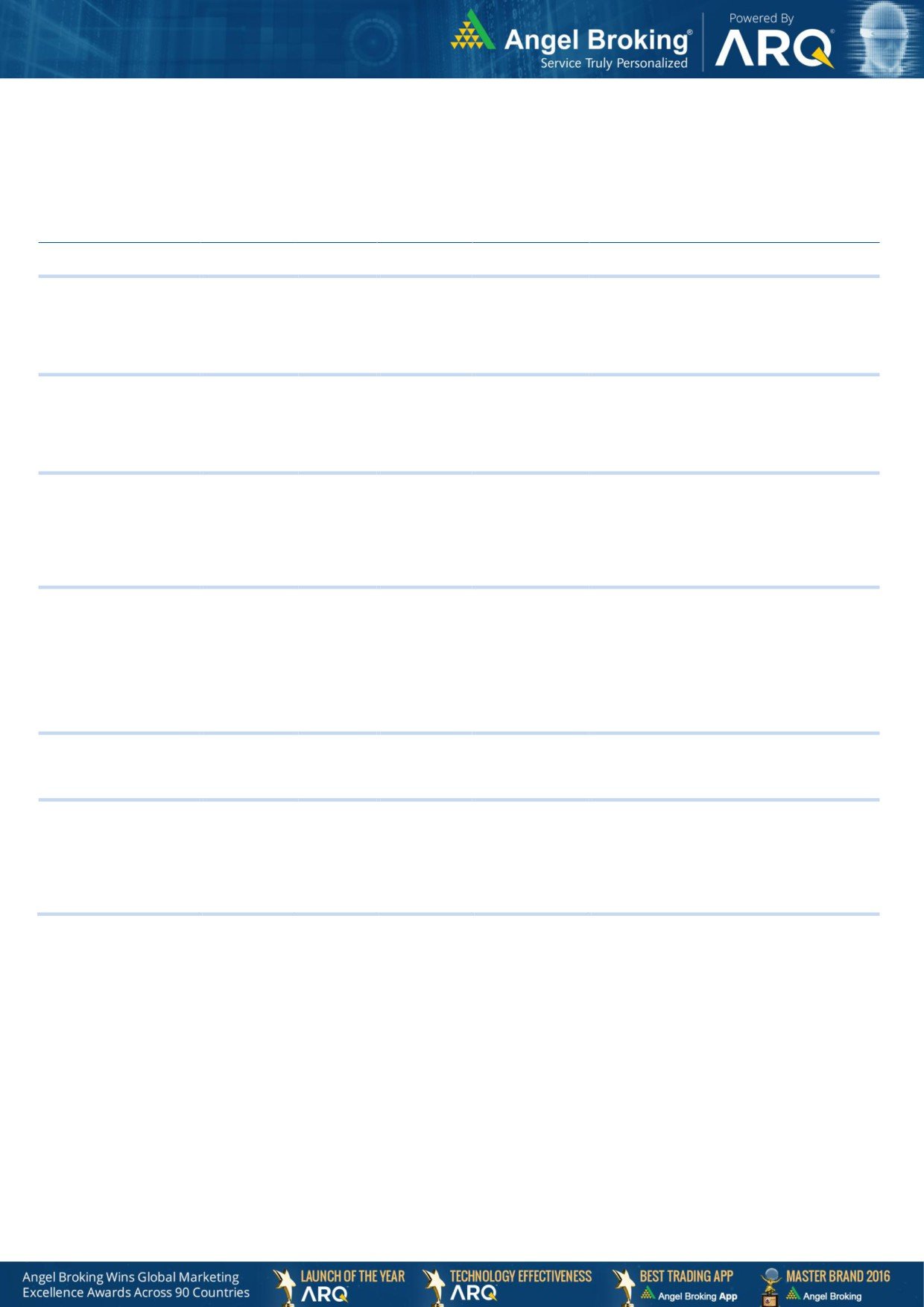

Market Outlook

August 16, 2019

Continued...

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

SHTF is in the sweet spot with benefits from

stronger CV volumes, NIMs unaffected by

Shriram Transport Finance

rising bond yields on the back of stronger

23,613

1,041

1,470

41.2

pricing power and an enhancing ROE by

750bps over FY18-20E, supported by decline

in credit cost.

We expect JSPL’s top line to grow at

27%

CAGR over FY19-FY20 on the back of strong

steel demand and capacity addition. On the

Jindal Steel & Power Limited

10,588

104

250

140.8

bottom line front, we expect JSPL to turn in to

profit by FY19 on back of strong operating

margin improvement.

GMM Pfaudler Limited (GMM) is the Indian

market leader in glass-lined (GL) steel

equipment. GMM is expected to cross CAGR

GMM Pfaudler Ltd

1,929

1,319

1,570

19.0

15%+ in revenue over the next few years

mainly led by uptick in demand from user

industries and it is also expecting to increase

its share of non-GL business to 50% by 2020.

Aurobindo Pharmaceuticals, amongst the

Indian Pharmaceutical companies, is well

placed to face the challenging generic

markets, given its focus on achieving growth

Aurobindo Pharmaceuticals

35,482

606

890

47.0

through productivity. Aurobindo will report net

revenue & net profit CAGR of ~13% & ~8%

resp. during FY2018-20E. Valuations are

cheap V/s its peers and own fair multiples of

17-18x.

We believe advance to grow at a healthy

CAGR of 35% over FY18-20E. Below peers

RBL Bank

16,717

389

650

67.2

level ROA

(1.2% FY18) to expand led by

margin expansion and lower credit cost.

TTK Prestige has emerged as one of the

leading brands in kitchen appliances in India

after its successful transformation from a single

TTK Prestige

8,245

5,948

7,708

29.6

product company to offering an entire gamut

of home and kitchen appliances. We are

expecting a CAGR of 18% in revenue and 25%

in PAT over FY2018-20.

Maintain Hold.

Source: Company, Angel Research

Market Outlook

August 16, 2019

Fundamental Call

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

CCL is likely to maintain the strong growth

CCL Products

3,211

241

360

49.1

trajectory over FY18-20 backed by capacity

expansion and new geographical foray

We forecast Nilkamal to report top-line CAGR of

~9% to `2,635cr over FY17-20E on the back of

Nilkamal

1,475

989

2,178

120.3

healthy demand growth in plastic division. On the

bottom-line front, we estimate

~10% CAGR to

`162cr owing to improvement in volumes.

Elantas Beck India is the Indian market leader in

liquid insulation segment used in electrical

equipments like motors, transformers etc. It derives

Elantas Beck India Ltd

1,603

2,021

2,500

23.7

demand from several industries which are expected

to register 10%+ CAGR in demand in the coming

years. We can book out from the stock with 16%

profit at Rs. 2500 TP.

Greenply Industries Ltd (GIL) manufactures plywood

& allied products and medium density fibreboards

(MDF). GIL to report net revenue CAGR of ~14% to

Greenply Industries

1,781

145

256

76.2

~`2,478cr over FY2017-20E mainly due to healthy

growth in plywood & lamination business on the

back of strong brand and distribution network

L&T Fin’s new management is on track to achieve

L&T Finance Holding

20,765

104

210

102.3

ROE of 18% by 2020 and recent capital infusion of

`3000cr would support advance growth.

We expect loan book to grow at 24.3% over next

GIC Housing

1,155

214

424

97.8

two year; change in borrowing mix will help in NIM

improvement

Strong brands and distribution network would boost

Siyaram Silk Mills

1,078

230

549

138.7

growth going ahead. Stock currently trades at an

inexpensive valuation.

Expected to benefit from the lower capex

Music Broadcast Limited

1,110

40

95

136.6

requirement and 15 year long radio broadcast

licensing.

We expect Inox Wind to report exponential growth

in top-line and bottom-line over FY19-20E. The

growth would be led by changing renewable energy

industry dynamics in favor of wind energy segment

Inox Winds

966

44

120

175.5

viz. changes in auction regime from Feed-In-Tariff

(FIT) to reverse auction regime and Government’s

guidance for 10GW auction in FY19 and FY20

each.

Considering the strong CV demand due to change

in BS-VI emission norms (will trigger pre-buying

activities), pick up in construction activities and no

Ashok Leyland

18,332

62

156

149.8

significant impact on industry due to recent axle

load norms, we recommend BUY on Ashok Leyland

at current valuations.

Well planned strategy to grow small business loans

and cross-selling would propel fees income. We

Yes Bank

17,752

77

NA

NA

expect YES to grow its advance much higher than

industry and improvement in asset quality to

support profitability.

Market Outlook

August 16, 2019

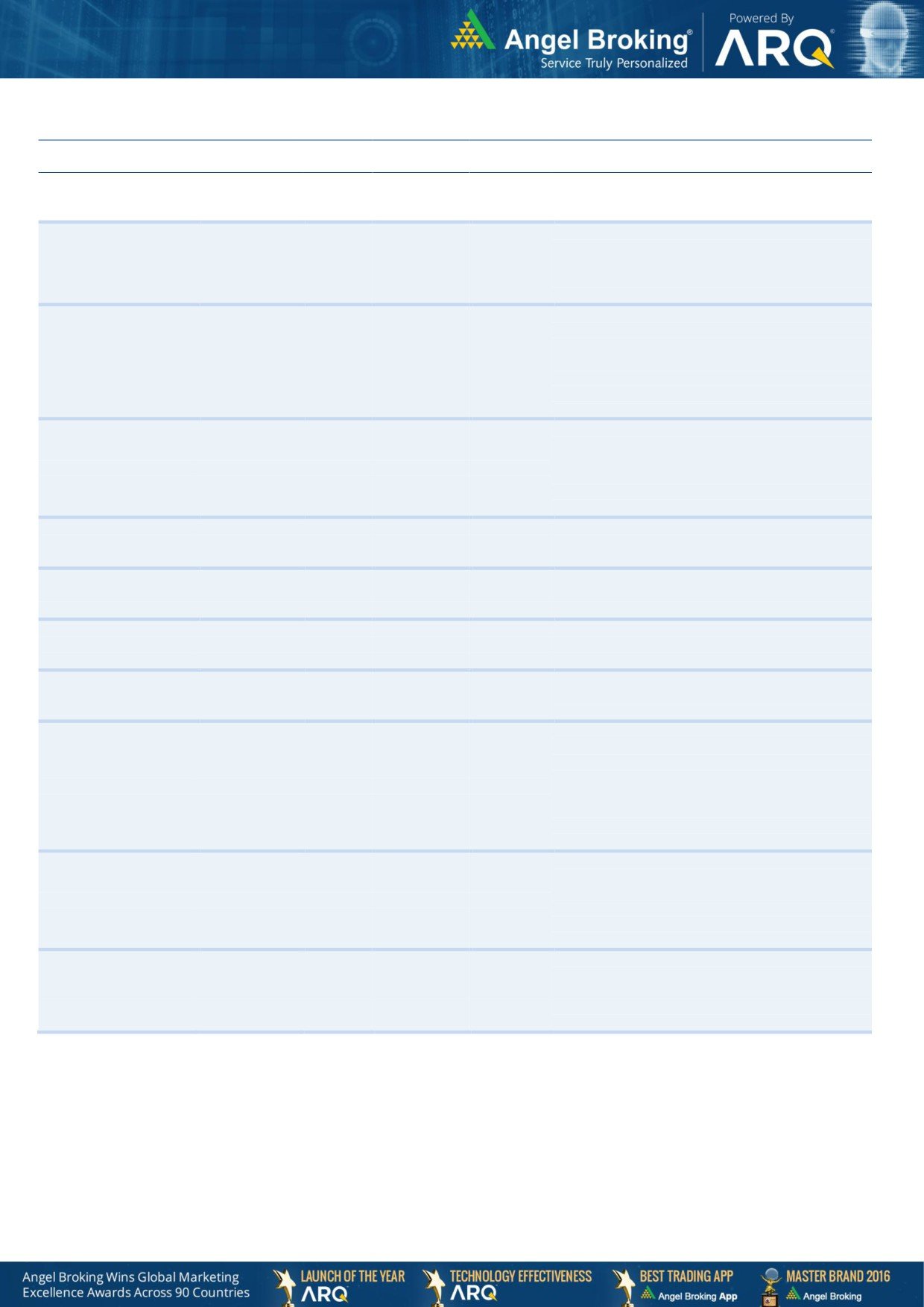

Global economic events release calendar

Date

Time

Country

Event Description

Unit

Period

Bloomberg Data

Last Reported

Estimated

May 16, 2019

JN

Housing Starts YoY

% Change

Sep

0.02

(0.01)

May 17, 2019

JN

Annualized Housing Starts

% Change

Sep

0.957m

0.950m

May 17, 2019

JN

Construction Orders YoY

% Change

Sep

0.01

--

May 20, 2019

12:00 AM

ES

Industrial Production YoY

% Change

Sep

0.06

--

May 21, 2019

12:00 AM

RO

ILO Unemployment Rate

% Change

Sep

0.04

--

May 24, 2019

3:15 AM

DE

Unemployment Rate SA

% Change

Sep

0.03

--

May 25, 2019

4:30 AM

DE

Unemployment Rate Gross Rate

% Change

Sep

0.04

0.04

May 26, 2019

4:30 AM

FI

Trade Balance

% Change

Aug F

-400m

--

May 28, 2019

4:30 AM

TU

Economic Confidence

% Change

Oct

71.00

--

May 30, 2019

5:20 AM

TU

Trade Balance

% Ratio

Sep

-2.42b

-1.90b

May 30, 2019

5:20 AM

TU

Central Bank Inflation Report

%

June 02, 2019

5:30 AM

TH

Exports YoY

% Change

Sep

0.06

--

June 03, 2019

5:30 AM

TH

Exports

% Change

Sep

$22380m

--

June 04, 2019

5:31 AM

TH

Imports YoY

%

Sep

0.24

--

June 08, 2019

5:31 AM

TH

Imports

%

Sep

$21776m

--

June 09, 2019

5:31 AM

TH

Trade Balance

Thousands

Sep

$604m

--

June 10, 2019

6:00 AM

TH

BoP Current Account Balance

% Change

Sep

$753m

$1200m

June 11, 2019

0-Jan-00

AU

CPI YoY

% Change

3Q

0.02

0.02

Source: Company, Angel Research

Market Outlook

August 16, 2019

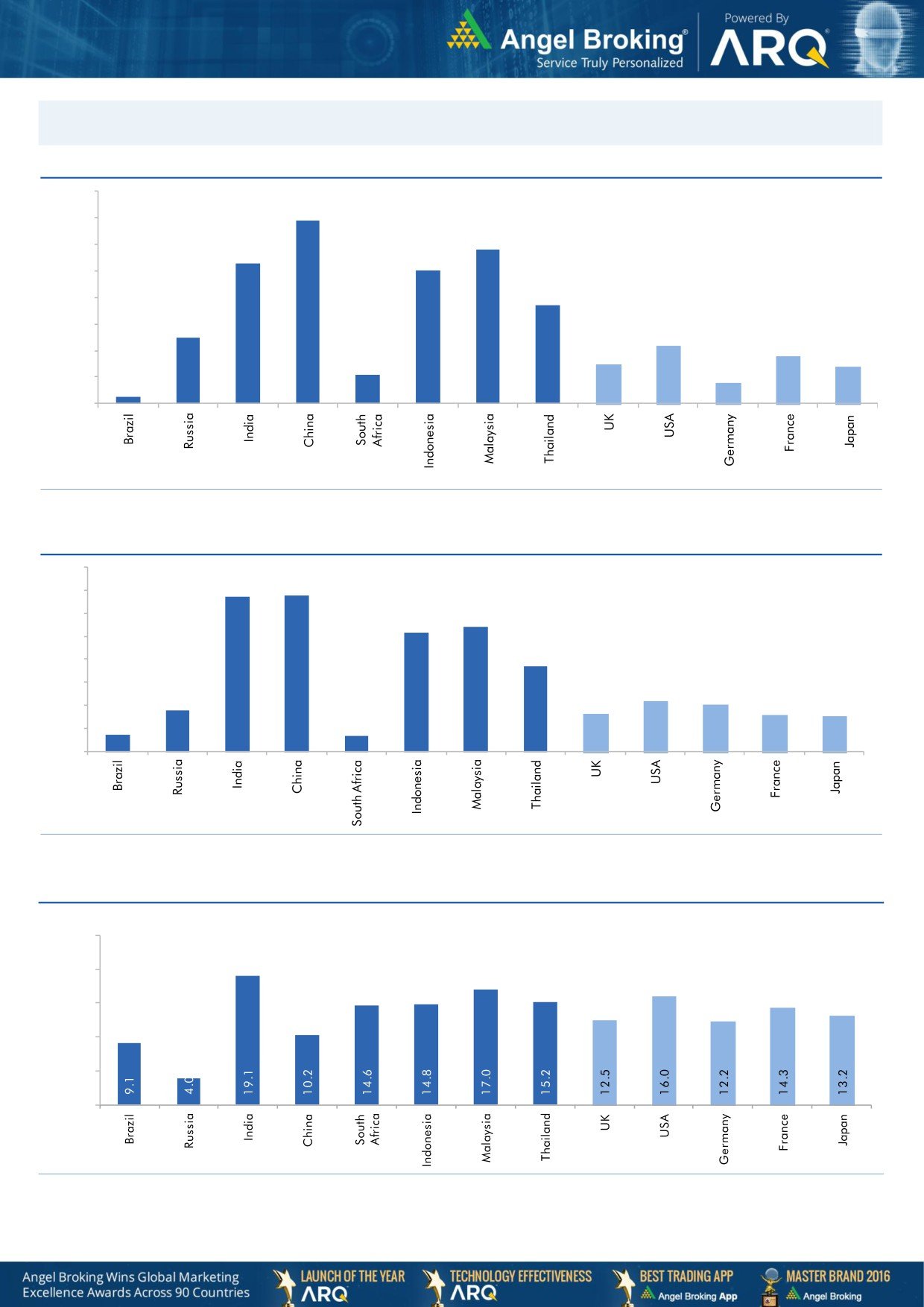

Macro watch

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

10.0

8.5

8.4

9.1

9.0

8.0

7.3

7.5

9.0

7.0

7.0

8.1

8.0

7.6

7.7

7.0

6.5

8.0

6.8

7.0

7.0

6.0

7.0

6.3

6.6

4.8

6.1

4.6

4.5

4.6

5.0

5.6

3.8

6.0

4.0

2.6

5.0

3.0

1.7

4.0

2.0

1.0

0.3

3.0

-

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

56.0

Mfg. PMI

Services PMI

(%)

6.0

5.2

5.07

54.0

4.9

4.9

5.0

4.4

4.6

4.3

4.2

52.0

3.7

3.7

4.0

3.4

50.0

3.0

2.6

2.3

2.1

2.0

48.0

2.0

1.0

46.0

-

44.0

Source: MOSPI, Angel Research

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

35.0

7.00

30.0

6.50

25.0

6.00

20.0

5.50

15.0

5.00

10.0

4.50

5.0

4.00

0.0

3.50

(5.0)

3.00

Source: Bloomberg, Angel Research As of 15 April, 2019

Source: RBI, Angel Research

Market Outlook

August 16, 2019

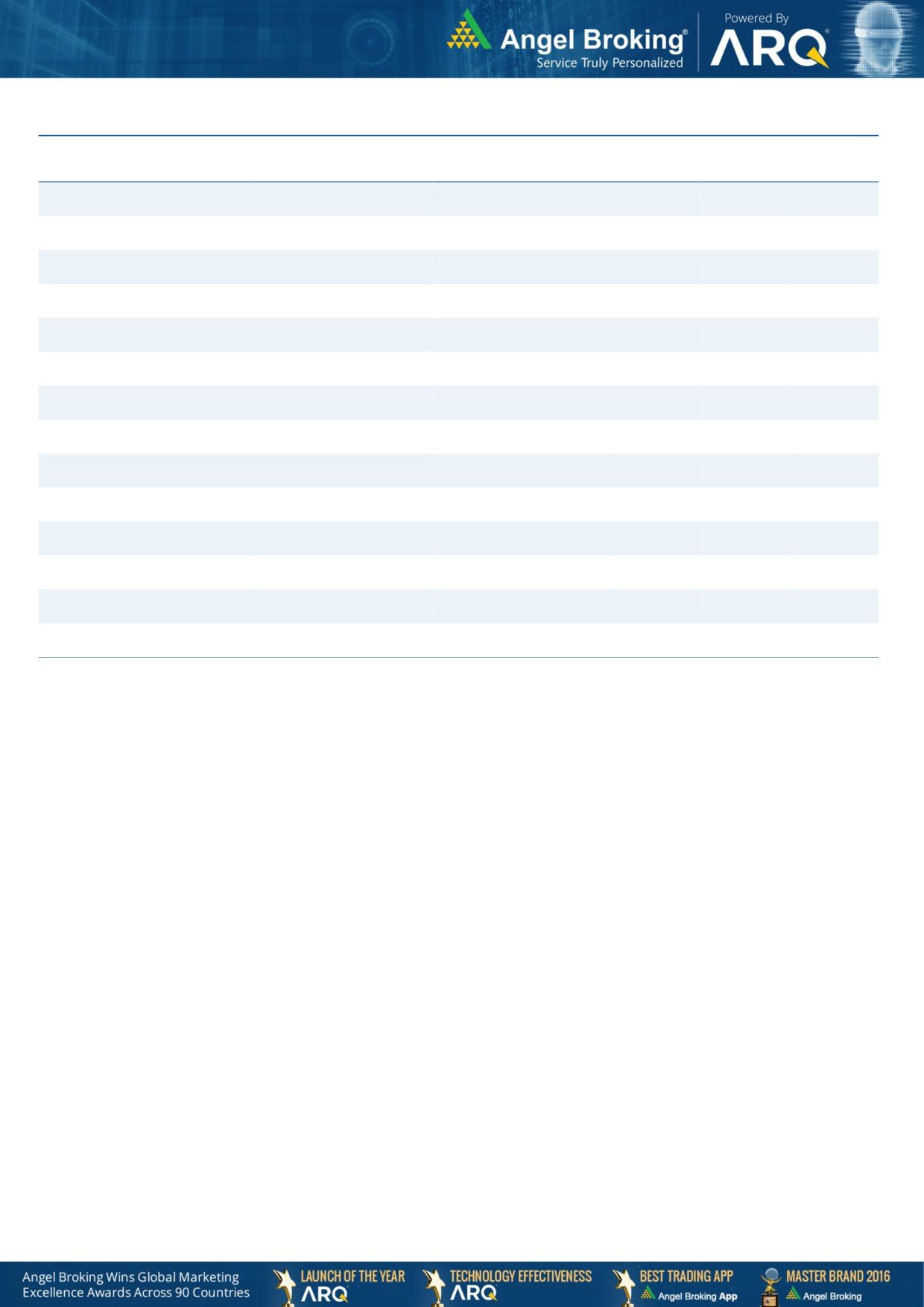

Global watch

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

8.0

(%)

6.9

7.0

5.8

6.0

5.3

5.0

5.0

1.1

3.7

4.0

2.5

3.0

2.2

1.8

2.0

1.5

1.4

0.8

1.0

0.3

-

Source: Bloomberg, Angel Research

Exhibit 2: 2017 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

6.7

6.8

7.0

6.0

5.4

5.2

5.0

3.7

4.0

3.0

1.8

2.2

2.0

1.7

1.6

1.5

2.0

0.7

0.7

1.0

-

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

25.0

20.0

15.0

10.0

5.0

-

Source: IMF, Angel Research As of 25 Sep, 2018

Market Outlook

August 16, 2019

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

1,00,995

4.1

5.8

38.8

Russia

Micex

2,559

0.0

1.5

10.9

India

Nifty

11,789

-1.1

1.4

10.0

China

Shanghai Composite

2,979

2.8

-3.6

4.6

South Africa

Top 40

51,925

3.8

9.7

3.7

Mexico

Mexbol

44,686

-11.2

-15.1

-11.3

Indonesia

LQ45

1,006

-3.2

4.1

-8.5

Malaysia

KLCI

1,708

1.4

1.7

-8.0

Thailand

SET 50

1,099

0.2

0.6

-8.9

USA

Dow Jones

26,600

7.2

2.6

9.6

UK

FTSE

7,426

3.7

2.0

-2.8

Japan

Nikkei

21,276

3.3

0.3

-4.6

Germany

DAX

12,399

5.7

7.6

0.8

France

CAC

5,539

6.4

3.5

4.0

Source: Bloomberg, Angel Research As of 06 July, 2019

Market Outlook

August 16, 2019

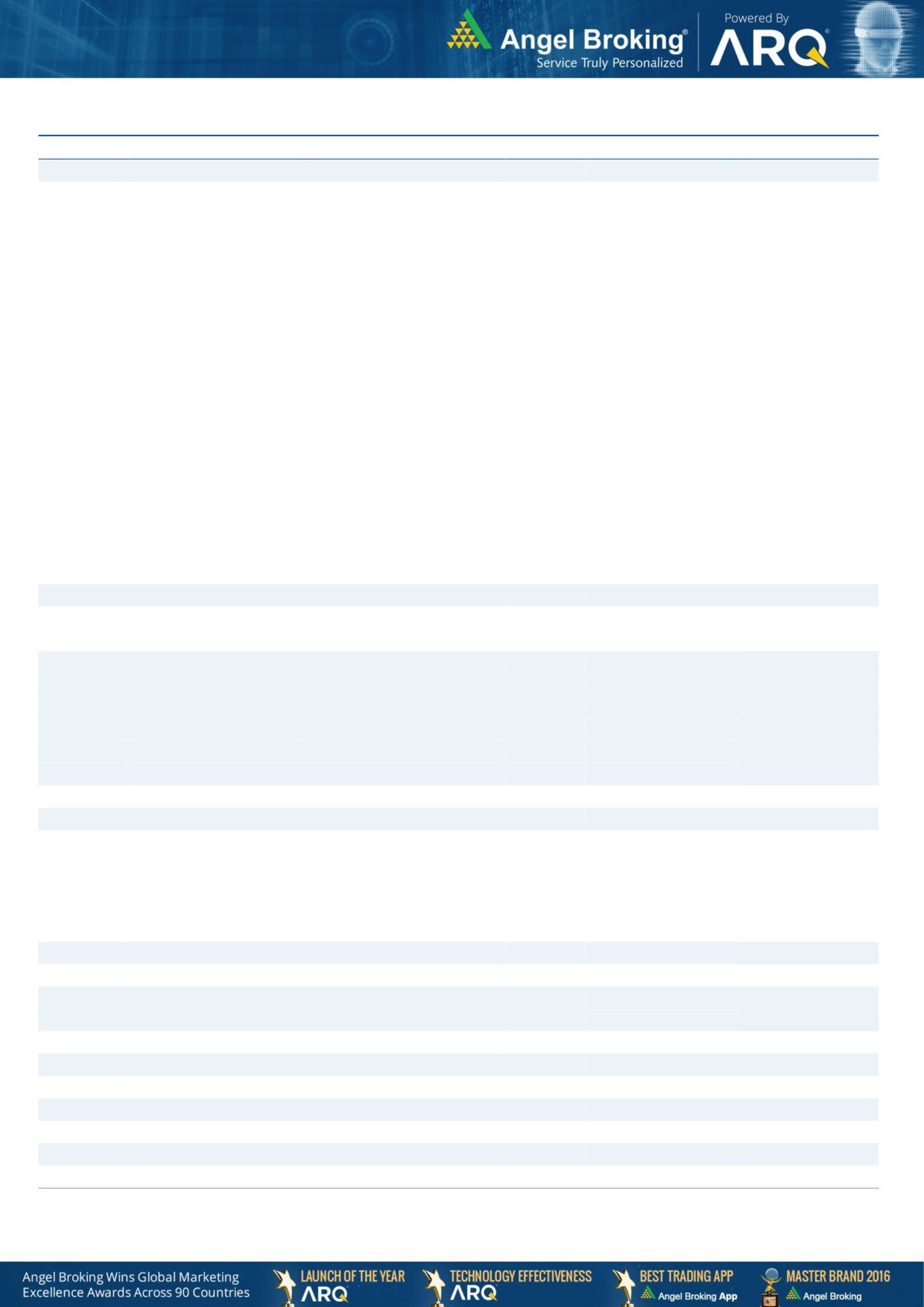

Exhibit 7: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

17-08-2018

Top Picks

Ashok Leyland

128

156

Open

10-08-2018

Top Picks

Inox Wind

107

127

Open

30-11-2018

Top Picks

TTK Prstige

7,206

8,200

Open

09-08-2018

Top Picks

TTK Prstige

6,206

7,500

06-07-2018

Top Picks

Aurobindo Pharma

603

780

Open

30-08-2018

Top Picks

RBL Bank

626

690

Open

06-07-2018

Top Picks

RBL Bank

565

670

06-07-2018

Top Picks

Yes Bank

348

418

Open

30-06-2018

Top Picks

Jindal Steel & Power

222

350

Open

20-06-2018

Top Picks

Shriram Transport Finance Com

1,466

1,764

Open

30-07-2018

Top Picks

Bata India

918

1,007

Open

23-07-2018

Top Picks

Bata India

842

955

01-07-2018

Top Picks

Bata India

862

948

18-06-2018

Top Picks

Bata India

779

896

14-06-2018

Top Picks

Amber Enterprises

1,026

1,230

Open

07-06-2018

Top Picks

M&M

918

1050

Open

04-05-2018

Top Picks

M&M

860

990

03-05-2018

Fundamental

L&T Finance Holding

171

210

Open

02-05-2018

Top Picks

HDFC Bank

1944

2315

Open

04-05-2018

Top Picks

Matrimony.com Ltd

573

1016

Closed(17/08/2018)

20-04-2018

Top Picks

Matrimony.com Ltd

781

984

15-05-2018

Top Picks

Parag Milk Foods Limited

310

410

Open

16-04-2018

Top Picks

Parag Milk Foods Limited

249

333

27-08-2018

Top Picks

GMM Pfaudler Limited

1,170

1,287

Open

18-08-2018

Top Picks

GMM Pfaudler Limited

1,024

1,200

07-08-2018

Top Picks

GMM Pfaudler Limited

984

1,100

29-06-2018

Fundamental

GMM Pfaudler Limited

932

1,020

14-05-2018

Fundamental

GMM Pfaudler Limited

818

900

06-04-2018

Fundamental

GMM Pfaudler Limited

712

861

07-03-2018

Fundamental

Ashok Leyland Ltd

139

163

Closed (26/04/2018)

03-03-2018

Fundamental

Greenply Industries

340

395

Open

27-08-2018

Top Picks

Safari Industries

974

1,071

Open

14-08-2018

Top Picks

Safari Industries

868

1,000

07-08-2018

Top Picks

Safari Industries

788

870

16-07-2018

Top Picks

Safari Industries

693

800

16-04-2018

Top Picks

Safari Industries

651

750

21-02-2018

Top Picks

Safari Industries

532

650

31-05-2018

Top Picks

HSIL Ltd

348

Closed (31/05/2018)

16-02-2018

Top Picks

HSIL Ltd

433

510

07-02-2018

Fundamental

Elantas Beck India Ltd.

2155

2500

Open

01-02-2018

Top Picks

ICICI Bank

352

416

Open

01-02-2018

Top Picks

Aditya Birla Capital

167

218

Open

04-01-2018

Fundamental

CCL Products

278

360

Open

03-01-2018

Fundamental

Nilkamal Ltd

1880

2178

Open

01-01-2018

Fundamental

Capital First Ltd

693

850

Closed (15/01/2018)

30-12-2017

Fundamental

Shreyans Industries Ltd

205

247

Closed

Source: Company, Angel Research

Market Outlook

August 16, 2019

Exhibit 8: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

Fundamental

Prism Cement Ltd

160

Closed (09/05/2018)

21-12-2017

Fundamental

Prism Cement Ltd

118

131

18-12-2017

Fundamental Menon Bearings Limited

92

114

Closed (17/01/2018)

14-12-2017

Top Picks

Ruchira Papers Ltd.

188

244

Closed (09/02/2018)

17-05-2018

Top Picks

Century Plyboards India

280

Closed(17/05/2018)

28-11-2017

Top Picks

Century Plyboards India

317

400

19-12-2017

Top Picks

LT Foods

85

Closed(18/06/2018)

06-11-2017

Top Picks

LT Foods

74

96

16-10-2017

FundamentalEndurance Technologies Ltd

1111

1277

Closed (01/12/2017)

11-09-2017

Top Picks

GIC Housing

533

655

Open

10-10-2017

Top Picks

Music Broadcast Limited

404

475

Open

20-07-2017

Top Picks

Music Broadcast Limited

368

434

07-07-2017

Fundamental L&T Finance Holdings Ltd

149

179

Closed (28/8/2017)

06-07-2017

Fundamental

Syngene International

478

564

Closed (1/3/2018)

05-07-2017

Top Picks

Maruti

7371

10619

Open

05-06-2017

Top Picks

Karur Vysya Bank

127

100

Closed (12/03/2018)

23-05-2018

Top Picks

KEI Industries

481

589

Open

04-01-2017

Top Picks

KEI Industries

125

485

31-05-2018

Top Picks

Alkem Lab

1978

Closed (31/05/2018)

01-12-2016

Top Picks

Alkem Lab

1700

2441

17-10-2016

Top Picks

Asian Granito

267

534

Closed (18/02/2018)

17-05-2018

Top Picks

TV Today Network

460

Closed (17/05/2018)

04-08-2016

Top Picks

TV Today Network

297

603

05-04-2016

Top Picks

DHFL

189

720

Open

25-06-2018

Top Picks

Navkar Corporation

207

Closed(25/06/2018)

05-01-2016

Top Picks

Navkar Corporation

207

265

Open

08-12-2015

Top Picks

Blue Star

357

867

Open

30-10-2015

Top Picks

Siyaram Silk Mills

186

851

Open

Source: Company

Market Outlook

August 16, 2019

Research Team Tel: 022 - 39357800

DISCLAIMER:

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.